First, let’s consider the State Pension, which is by and large fully protected against inflation. The earliest you can claim it is at State Pension age. You do not have to stop work to claim your State Pension.

Since November 2018, women and men have had the same State Pension age, which has been increasing. If you were born between 6 September 1954 and 5 April 1960, your State Pension age is 66. After that, there is a further gradual rise to age 67 and, for people born after 5 April 1978, age 68 (though this may be brought forward). Any further rises are meant to depend on whether life expectancy increases. You can check your State Pension age and date online at GOV.UK (Directory, p 32).

Many workplace pension schemes align their normal pension age with State Pension age. Pension age is not the same as retirement age. Since October 2011 the default retirement age (which used to be 65) has been scrapped. Employers are no longer allowed to dismiss staff because of age.

Because some people retire and start drawing a workplace pension early, they can mistakenly assume it is possible to get an early State Pension. This is not correct – State Pension is never payable before State Pension age. However, if you’re retiring early because of, say, ill health or the need to care for some-one, you might be eligible to claim other state benefits (see Chapter 2).

Getting your State Pension

Your State Pension is not paid automatically; you need to claim it. You’ll usually get a letter two months before your State Pension birthday inviting you to make a claim and telling you how to do this. If you don’t receive a letter, you can still claim online at GOV.UK (Directory, p 32), or by post or phone by contacting the Pension Service: 0800 731 7898.

All State Pensions are taxable, even though they are paid without any tax deducted. Chapter 4 explains how tax is collected on State Pensions if your income is high enough for you to pay tax. State pensioners also get a £10 bonus paid shortly before Christmas, and this is tax-free.

(The bonus was introduced and set at £10 back in 1972, when it could have bought a hearty family meal. To keep pace with inflation it would have needed to increase to £110 today.)

State Pensions are increased in April each year – but if you retire abroad see Chapter 7.

When you reach State Pension age, you decide whether or not to start drawing the State Pension. Retirement does not have to start on any particu-lar date or on a single day. Many people prefer to stop working gradually by reducing hours or shifting to part-time work, so you might not need all your pensions straight away. By deferring your State Pension, you can have a bigger pension when it does start or, if you are covered by the old state scheme rules (see below), alternatively a lump sum.

Pensions are usually paid every four weeks direct into a bank account. This can be a bank or building society account or credit union account. Individuals who genuinely cannot use a bank account can ask the Pension Service to pay them by cheque, which can be cashed, for example, at the Post Office.

Your right to a State Pension

You build up your right to claim a State Pension by paying, or being cred-ited with, National Insurance contributions (NICs). Each year that counts is called a ‘qualifying year’. How many qualifying years you need during your working life (defined as the years from age 16 up to State Pension age) depends on when you reached or will reach State Pension age.

If you reached State Pension age before 6 April 2016, you will be in the old State Pension scheme. There were two types of State Pension – basic and additional. From 6 April 2010, the number of qualifying years needed to get a full basic State Pension was reduced to 30 years for women and men (before this it was normally 39 and 44 years respectively). If you reach(ed) State Pension age on or after 6 April 2016, you will be in the new single-tier State Pension system, and need 35 years to get the full amount and at least 10 qualifying years to get any State Pension at all. You can check your National Insurance record at GOV.UK (Directory, p 32).

Anyone trying to decide whether they can afford to retire should get a statement of their State Pension from the Pension Service (Directory, p 32). It is worth getting an early estimate of what your pension will be, as there may be steps you can take to improve your NICs record as described below.

You stop paying National Insurance once you reach State Pension age.

PAYING NATIONAL INSURANCE CONTRIBUTIONS

If you are an employee, your employer will have automatically deducted Class 1 NICs from your salary, provided your earnings were above the ‘primary threshold’ (in 2023/24, this is £242 a week). Your employer hands these contributions to the government, which keeps a record of your quali-fying years.

If you are self-employed, you will have been paying flat-rate Class 2 NICs, currently £3.45 every week. These count towards your State Pension. If your profits are less than a given threshold (2023/24: £6,275), you can opt out of paying Class 2 contributions, but if you don’t yet have enough qualifying years for the full pension it’s usually better to pay these NICs if you can afford it. As a self-employed person, you may also be paying Class 4 NICs. These are purely a tax on your profits (between limits) and do not count towards the State Pension at all.

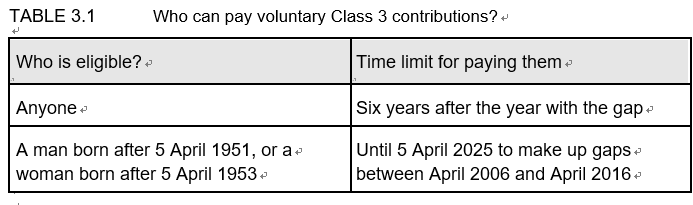

If you have gaps in your NICs record – for example, because you have been studying at university or taken some time out to travel – you can go back up to six years to fill the gaps by paying Class 3 voluntary

contributions. Exceptionally, some people can fill gaps from longer ago – see Table 3.1. In 2023/24, Class 3 NICs cost £15.85 a week. It will only be worth paying these if you don’t already have enough qualifying years for a full State Pension. You can check whether it is worth your while paying them by contacting the government’s Future Pensions Centre (Directory, p 31).

LIVED OR WORKED OUTSIDE GREAT BRITAIN?

If you have lived in Northern Ireland or the Isle of Man, any contributions paid there will count towards your pension. The same should also apply in most cases if you have lived or worked in an EU country (and this continues to be the case post-Brexit), or any country whose social security is linked to Britain’s by a reciprocal arrangement, in which case, parts of your pension may be paid from different sources. You can check your position by contact-ing the government’s International Pension Centre (Directory, p 32).

CARING FOR CHILDREN OR ADULTS

If you were a carer for a child or a disabled person throughout any tax year after 1978 up until 5 April 2010, you may have got Home Responsibilities Protection. HRP reduced the number of qualifying years you needed for a full basic State Pension. HRP was awarded automatically if you got Child Benefit for a child under 16, but if you were caring for a disabled person or you were a foster carer, you usually had to complete an application form.

From 6 April 2010, HRP was replaced with weekly credits for parents and carers, called Carer’s Credit. You can receive these credits for any weeks you are getting Child Benefit for a child under 12, you are an approved foster carer or you are caring for one or more sick or disabled people for at least 20 hours a week. If you reach State Pension age on or after 6 April 2010, any years of HRP you have been awarded before April 2010 will have been converted to qualifying years of credits, up to a maximum of 22 years.

Carer’s Credits are awarded automatically if you are claiming Child Benefit, even if this is a ‘nil claim’. You may want to make a nil claim because of the interaction between Child Benefit and the income tax system. Since April 2013, if you are getting Child Benefit and you or your partner (if you have one) have taxable income of £50,000 or more, the higher earner has to pay extra income tax called a High Income Child Benefit Tax Charge. The effect is to claw back some or all of the Child Benefit. If you or your partner are caught by this tax charge, you’ll have to declare it by completing a tax return each year. That can be inconvenient and you may have decided it’s simpler just to stop getting the Child Benefit. In that case, though, you should still register for Child Benefit, but on the form put ‘no’ at the ques-tion that asks if you want to be paid the benefit. That way, you will still get Carer’s Credits towards your State Pension.

Since 2011, the Carer’s Credit that goes with Child Benefit can be trans-ferred to someone else if they are caring for the child or children. For example, if you are a grandparent looking after your son’s or daughter’s children, you could apply to have their Carer’s Credit transferred to you to help you build up your State Pension. Complete the application form for Specified Adult Childcare Credit at GOV.UK (search using your web browser).

OTHER SITUATIONS WHEN YOU MAY GET CREDITS

If you have been in any of the following situations you will have been cred-ited with contributions (instead of having to pay them):

- You were sick or unemployed (provided you sent in sick notes to your social security office, signed on at the unemployment benefit office or were in receipt of Jobseeker’s Allowance).

- You were a man over the women’s State Pension age, but under 65 and not working, during the period when women’s State Pension age was lower than men’s.

- You were entitled to maternity allowance, invalid care allowance or unemployability supplement.

- You were taking an approved course of training.

- You had left education but had not yet started working.

- (post-April 2000) Your earnings were between what is known as the lower earnings limit and the primary threshold. These change each year, and in 2023/24 are £123 and £242 a week, respectively.

MARRIED WOMEN AND WIDOWS

Under the old State Pension system, married women and widows who do not qualify for a basic pension in their own right or have built up a rela-tively low State Pension may be entitled to a basic pension based on their husband’s NICs record, at about 60 per cent of the level to which he is enti-tled. In 2020, it came to light that up to 200,000 women who reached State Pension age before April 2016 may not have received this pension and other state pension elements to which they are entitled, worth an estimated £2.7 billion. The government is now reviewing these cases, and, if you think you might be affected, contact the Pension Service.

A dwindling number of women retiring today may have paid the married women’s reduced-rate NICs (sometimes called the ‘small stamp’). If this applies to you and you and/or your husband reach State Pension age on or after 6 April 2016, special rules mean you may still be able to claim a pension based on your husband’s NICs record. Contact the Pension Service for more information.